Please Wait 11 seconds.

Understanding Bitcoin is sometimes difficult for newcomers because it’s really two things:

- digital gold

- a payment network

Bitcoin vs Other Payment Networks

In terms of acting as payment network, Bitcoin works quite differently from other online payment systems such as PayPal or Venmo. These traditional forms of payment over the internet, which are tied to the legacy financial system, involve the use of centralized, trusted third parties to order transactions and keep track of user account balances.

Bitcoin is Permissionless

In the case of Bitcoin, those who are in charge of ordering transactions are dynamic and potentially anonymous. This is the key differentiator to understand about Bitcoin.

The way in which transactions are processed allows bitcoin to act in a permissionless, censorship-resistant, and apolitical manner.No single entity is in control of the financial activity that happens on the network.

What is needed is an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party.The above quote is what the pseudonymous Satoshi Nakamoto wrote in the original Bitcoin white paper.

Nakamoto effectively created a decentralized solution to what is known as the double-spending problem. This was an issue seen in many previous digital payment systems.

Bitcoin as Digital Gold

Now that we’ve covered Bitcoin as a payment network, let’s take a look at bitcoin as a form of digital gold.

Bitcoin is often referred to as digital cash due to its ability to be transacted over the internet in a manner similar to physical cash, but the digital gold analogy makes more sense due to the monetary properties of bitcoin.

In the beginning, 50 bitcoin were created roughly every ten minutes, but that increase in supply is halved every four years.

The issuance schedule will continue until around the year 2140, when the supply will be capped at nearly 21 million bitcoins.This monetary policy is a part of the Bitcoin network’s consensus rules, and there is no central banker in charge of controlling the supply.

CHAPTER 2

Why is Bitcoin Important?

Bitcoin is important because, before it existed, there was no true form of digital gold. The existence of a digital, cash-like asset opens up a whole new world of opportunities that would simply not be possible via the centralized online currencies of the past.

Bitcoin creates the possibility for privacy in online transactions, which would not be possible when there is a regulated bank or other financial institution responsible for payment processing.

And criminals aren’t the only ones who should care about online privacy. Online privacy is effectively part of one’s personal security these days .

Bitcoin has also proven useful as a way to get around many of the onerous financial regulations seen around the world. In the past, Abra CEO Bill Barhydt has discussed how the programmable nature of bitcoin has enabled his company to build a global, non-custodial bank that doesn’t need to deal with anywhere near as much regulatory compliance as a traditional financial institution.

The world is also becoming an increasingly cashless society, which can sound great at first but comes with a large amount of dystopian baggage. Without something like bitcoin, the world’s financial system effectively becomes a tool for mass surveillance as more activity is done through smartphones rather than physical cash.

Many economists and governments around the world would love to see a movement away from cash for a variety of reasons. For example, a cashless society would allow central bankers to more easily implement negative interest rates . Additionally, lawmakers would be able to more easily collect taxes, enact capital controls, and generally control people’s money when they can simply tap a bank on the shoulder to gain access to anyone’s financial history or the money itself.

Obviously, the prevention of things like terrorist financing and money laundering is another key point brought up by those who would like to see cash almost completely removed from the economy. But the problem is that digital currency is a black and white matter. Either people have full control over their digital assets and can move them privately or they can’t. Encryption backdoors do not work .

Governments view the aforementioned reasons for moving to a cashless society as nothing more than a boon for law and order, but the reality is this situation would create a complete surveillance state, at least in terms of people’s finances.

Bitcoin is effectively a much-needed alternative for this potentially Orwellian future where governments are able to surveil all financial activity, tell people who they can and can’t transact with, and easily steal from individuals through bail-ins or the inflation tax.

In summary, bitcoin is important because it creates an alternate financial system that will allow individuals to freely transact and store wealth in an apolitical manner.

The best way to explain how Bitcoin works is to go through an example of how things function behind the scenes when a user sends or receives a transaction on the network. Let’s run through both sides of a transaction from the perspective of two hypothetical users: Bob and Alice.

Before sending or receiving some bitcoin, Bob must download software that can interact with the Bitcoin network such as Bitcoin Core. When Bob runs this software for the first time, it will download the complete history of every transaction that has ever been made on the Bitcoin network. This is known as the initial block download (IBD).

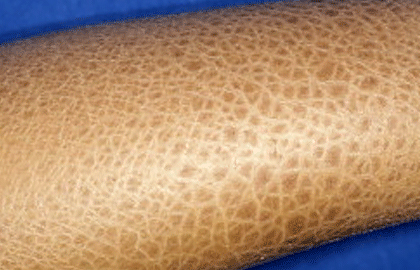

In Bitcoin, every user is responsible for making sure new transactions are following the network’s consensus rules. This is the only way to confirm that some received bitcoin is not fake. It’s sort of like guarding against a counterfeit dollar bill or tungsten dressed up like gold. To confirm the authenticity of some received bitcoin, a user must have access to the entire history of Bitcoin transactions, beginning with the network’s launch back in 2009 (although the vast majority of this data can later be pruned).

The history of transactions downloaded by Bob are grouped together in blocks, and new blocks are generated on the network roughly every ten minutes. These blocks of transactions are ordered in a chain known as the blockchain.

In order to download the entire blockchain, Bob connects with other peers on the network. He is able to decipher which chain of transactions leads to the correct state of the Bitcoin network because it will be the chain with the most proof-of-work behind it, while also following the consensus rules outlined in Bob’s local Bitcoin software client.

Proof-of-work is used in Bitcoin to decide who gets to add a new block of transactions to the blockchain. A traditional online payment system would have a trusted third party order transactions on the network, but the point of Bitcoin is to act in an apolitical, permissionless manner. When proof-of-work is used instead of a trusted third party, transactions can be ordered by a dynamic, potentially-anonymous group of individuals or entities, which are known as bitcoin miners. This structure makes the system extremely difficult to shut down.

During the process of creating a new block, miners are expending computing power to solve an extremely complex math problem. The miner who is able to solve the math problem first is awarded with the privilege of adding a new block of transactions to the blockchain. Miners are willing to spend expensive computing resources on this work because they are also rewarded with newly-created bitcoin and any transaction fees associated with the transactions in the newly added block.

Bob wants to receive some bitcoin from Alice, so he sends his newly-generated Bitcoin address to her. We’ll assume that Alice already has some bitcoin for this hypothetical scenario.

Alice sends Bob the bitcoin by signing a message with the private key associated with one of her Bitcoin addresses that already has some bitcoin associated with it. The message simply says that the bitcoin associated with Alice’s address should be reassigned to Bob’s address. This message is then broadcast to the Bitcoin network by Alice’s software client. Bob’s software client sees the transaction, but he must wait for the transaction to be included in a new block for it to be real and confirmed. In fact, Bob will want to wait for up to six confirmations if he’s receiving a large amount of bitcoin from Alice in exchange for some goods or services ( see a deeper explanation of this point here ).

Bob knows that the transaction is legitimate because his Bitcoin software client checks to make sure that all of the rules of the network are being followed. Alice cannot create new bitcoin out of thin air or send some bitcoin that doesn’t belong to her because this sort of activity would be detected by Bob’s software.

Alice would potentially be able to trick Bob if he were trusting a third party with transaction validation. It could be argued that Bob is not a true user of the Bitcoin network if he’s outsourcing the validation of an incoming transaction to someone else. After all, the whole point of the Bitcoin network is to remove the need for trusted third parties.

CHAPTER 4

Click here if your redirect does not begin.

Who Controls Bitcoin?

The question of who controls bitcoin has been one of the more controversial topics discussed by users over the years.

In the earlier days, there existed a somewhat widespread belief that miners were in control of Bitcoin’s protocol rules. However, history has shown that users are ultimately in control.

The reason that users are in control of Bitcoin is that miners need to create blocks that people will find valuable. If miners try to change the rules of the system and create new types of blocks with different rules, then users will need to agree to the new ruleset and signal to miners that there will be plenty of economic activity on this new network with different rules.

If users don’t wish to follow the rule changes being put forth by miners, then the users can simply ignore those blocks with the new rules and stick with the old rules. This is because users running their own Bitcoin node software verify that the rules of the network are being properly followed. When miners are mining blocks that don’t have any users, they won’t be rewarded with the valuable block rewards that allow them to operate at a profit. Invalid blocks created by miners are effectively worthless.

This structure of incentives was put to the test in late 2017 when a plan from some of the largest bitcoin companies and miners to move to a new network with a larger block weight limit was abandoned after it was revealed miners would not be willing to mine on a network at a loss for an extended period of time.

The user-activated soft fork for Segregated Witness (SegWit) was a real-world example of users ignoring the recommendations of Bitcoin Core developers and opting to run code that was not included in an official release of the Bitcoin Core software.

At the end of the day, developers and miners are going to work on the network that is valued by users. Developers generally need to work within the confines of Bitcoin’s current consensus rules, and miners need to create blocks that follow those rules if they want to get a return on their investment.

It should be noted that Bitcoin users are able to opt out of the network and transact on a different network with different rules at any point in time. That said, there is a general stickiness to the rules of the Bitcoin network as they exist today because a money is more useful when there are more people who use it.

No comments